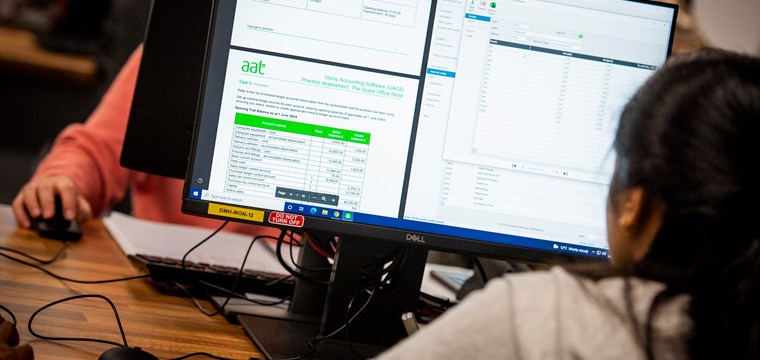

Sage Computerised Accounts (RQF)

COURSE CODE: BUSADM102

Location:

Online

Price:

£374.40

Day of the week:

Monday

Starting Date:

14/10/2024

Ending Date:

10/02/2025

Time:

18:00 - 21:00

Duration:

15 weeks

Your Course fees may be reduced based on individual circumstances. For further guidance, please refer to the funding rules or speak to a member of staff.

Enrol now